Excitement About Financial Advisor License

Wiki Article

The Best Strategy To Use For Advisors Financial Asheboro Nc

Table of ContentsThe Only Guide to Financial Advisor FeesThe Buzz on Financial AdvisorNot known Details About Financial Advisor Meaning The smart Trick of Advisor Financial Services That Nobody is Talking About

There are several sorts of monetary consultants available, each with differing qualifications, specialties, and levels of accountability. And also when you get on the search for an expert fit to your requirements, it's not unusual to ask, "Just how do I know which monetary expert is best for me?" The answer begins with a straightforward accounting of your requirements and a little of research.Kinds of Financial Advisors to Take Into Consideration Depending on your financial needs, you might choose for a generalised or specialized economic expert. As you begin to dive right into the world of seeking out a monetary expert that fits your requirements, you will likely be presented with several titles leaving you questioning if you are calling the right individual.

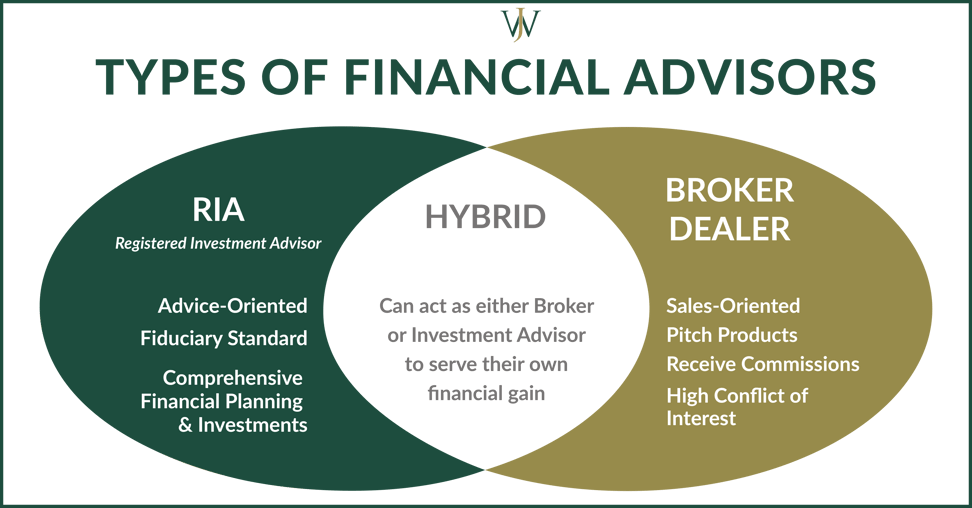

It is very important to note that some economic experts additionally have broker licenses (significance they can market securities), however they are not exclusively brokers. On the exact same note, brokers are not all qualified equally and are not monetary experts. This is simply one of the numerous factors it is best to begin with a qualified financial coordinator that can recommend you on your financial investments and also retired life.

Some Known Questions About Financial Advisor.

Unlike financial investment experts, brokers are not paid directly by customers, instead, they gain payments for trading stocks as well as bonds, as well as for marketing mutual funds and other products.

You can typically tell an advisor's specialized from his/her economic accreditations. As an example, a certified estate planner (AEP) is an advisor who focuses on estate preparation. When you're looking for an economic consultant, it's great to have a concept what you want aid with. It's likewise worth discussing economic planners. financial advisor.

A lot like "financial consultant," "monetary planner" is likewise a wide term. No matter of your details requirements and economic scenario, one requirements you need to strongly consider is whether a potential expert is a fiduciary.

An Unbiased View of Financial Advisor Jobs

To safeguard yourself from someone that is merely attempting to obtain more cash from you, it's a good concept to seek a consultant that is registered as a fiduciary. An economic consultant that is signed up as a fiduciary is called for, by law, to act in the very best interests this content of a customer.Fiduciaries can just advise you to make use of such products if they assume it's really the most effective monetary choice for you to do so. The United State Securities and Exchange Compensation (SEC) regulates fiduciaries. Fiduciaries who fail to act in a client's best interests might be struck with penalties and/or jail time of approximately one decade.

That isn't due to the fact that anybody can obtain them. Receiving either accreditation requires somebody to undergo a selection of courses and also tests, in enhancement to making a set amount of hands-on experience. The outcome of the certification procedure is that CFPs and also Ch, FCs are well-versed in topics across the area of individual money.

The charge could be 1. Fees generally lower as AUM boosts. The alternative is a fee-based consultant.

Some Ideas on Financial Advisor Magazine You Need To Know

A consultant's administration fee might or might not cover the expenses linked with trading this article safeties. Some consultants likewise charge a set charge per deal.

This is a solution where the advisor will pack all account monitoring costs, including trading charges and also expenditure ratios, right into one comprehensive fee. Since this cost covers much more, it is typically higher than a fee that only includes administration and leaves out points like trading costs. Cover fees are appealing for their simpleness yet likewise aren't worth the cost for everyone.

While a standard advisor usually bills a fee between 1% and 2% of AUM, the charge for a robo-advisor is typically 0. The big trade-off with a robo-advisor is that you usually do not have the capability to speak with a human consultant.

Report this wiki page